This weeks in crypto market we will discuss the Trump Trade, Ethereum ETF & market sentiment update for july, 19, 2024.

“The Trump Trade”

As the 2024 presidential election approaches, Trump is leading in many polls, and some investors are already pricing in a victory. The recent presidential debate and an assassination attempt on Trump have fueled anticipation. However, it’s essential to note that the stock market’s recent uptrend is primarily driven by robust corporate earnings rather than political news1.

In the cryptocurrency space, the “Trump Trade” has also made waves. Bitcoin, in particular, has been impacted. Throughout Trump’s time in office, his administration was viewed as more supportive of cryptocurrencies than subsequent administrations. As the election draws near, investors are closely monitoring how a potential Trump victory might affect crypto markets. The simultaneous surge in U.S. stocks, Treasury yields, and the dollar following Trump’s 2016 victory is a key reference point23.

Key Takeaways on Trump’s Influence on Crypto

- Former U.S. President Donald Trump’s recent embrace of cryptocurrencies has had a significant impact on the industry. Initially critical of crypto, Trump has now expressed support for it, attending crypto-focused events and praising the technology3.

- The crypto community has responded positively, viewing Trump as potentially beneficial for the industry. His pro-crypto stance contrasts with some left-leaning skeptics, and many believe he could provide a boon if elected3.

- Notably, after Trump’s recent shooting incident, Bitcoin’s price surged, reflecting the belief that it could improve his chances of winning the election4.

- Keep in mind that political events can influence market sentiment, and the crypto landscape remains dynamic. Stay informed and consider these factors when making investment decisions. 🚀📈342

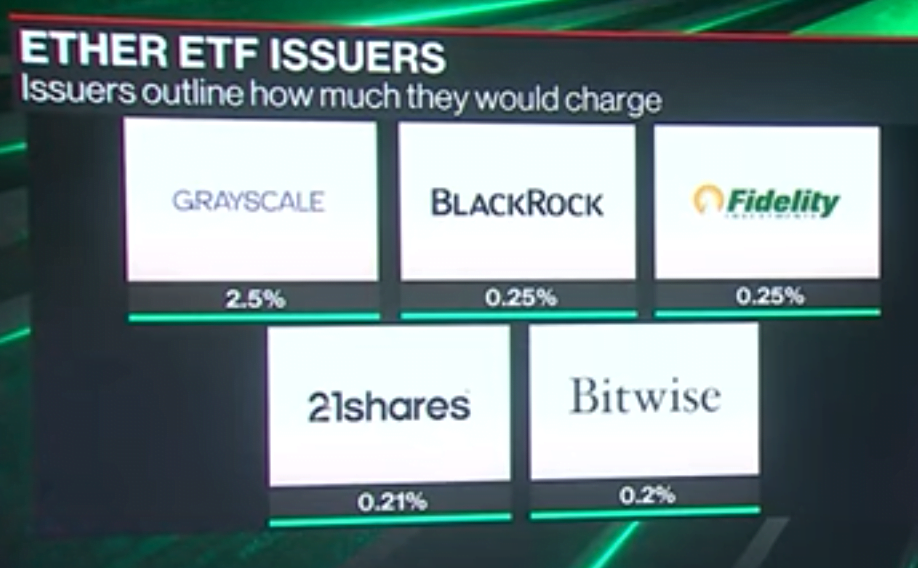

Ethereum ETF:

1. Ethereum ETFs Launch: A Game-Changer

The month of July is primarily focused on the potential launch of spot Ethereum ETFs. After the SEC’s approval, major players like BlackRock, VanEck, and Franklin Templeton are poised to introduce Ethereum ETFs. Unlike futures ETFs, which track future prices, spot Ethereum ETFs directly follow the current price of Ethereum. Optimism surrounding these ETFs has driven Ethereum’s price above $3,770, with potential for further gains.

Bitcoin’s Potential Moves

BTC JULY,24.

The “next leg” could push Bitcoin’s price as high as $110,000 as the cycle low has kicked in, according to several crypto traders.

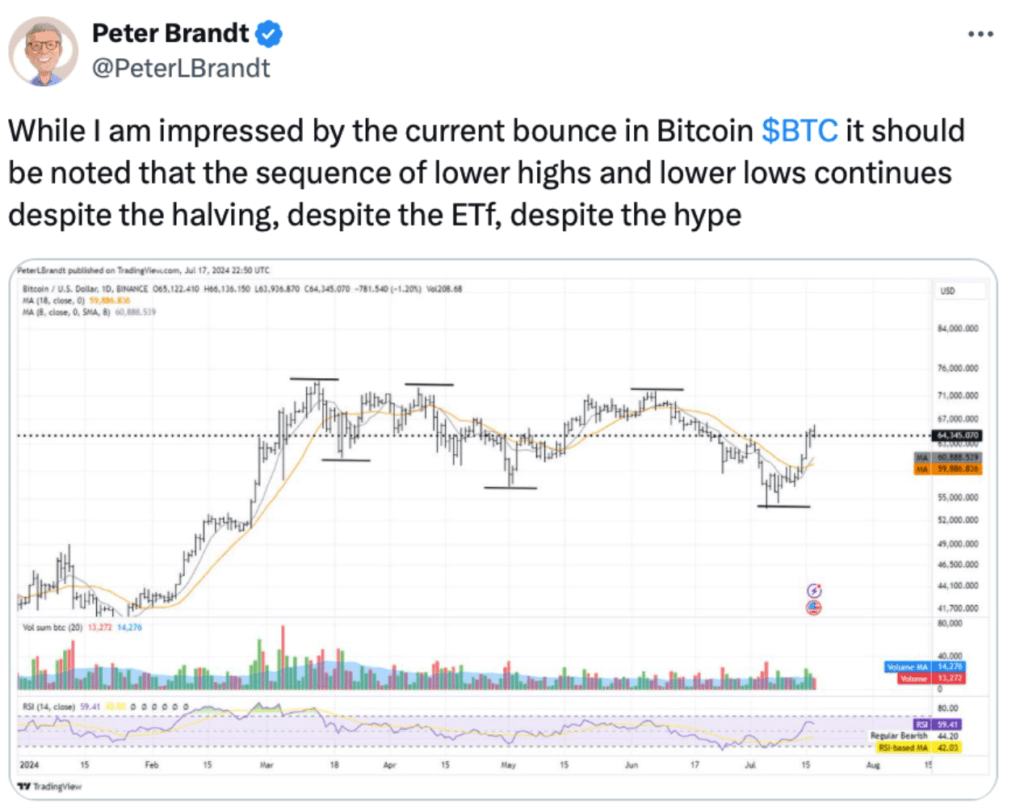

Bitcoin could jump to $110,000 on its next major rally, despite concerns of “lower highs and lower lows” forming as a pattern on the BTC price chart, according to crypto traders,

“The next leg is likely to bring Bitcoin to $110K,” founder of MN Capital Michael van de Poppe wrote in a July 17 post on X. It comes while other traders point out that Bitcoin BTC $64,286 is failing to reach previous highs, with each new high falling short of the last.

“It should be noted that the sequence of lower highs and lower lows continues despite the halving, despite the ETF, despite the hype,” veteran trader and analyst Peter Brandt stated in a July 17 post on X.

Keep an eye on BTC’s macro bearish pattern, which suggests a potential downward trend. The target price based on this pattern is $50,982, a four-month low. However, market sentiment remains dynamic, and external factors can influence crypto prices.

Macro Bearish Pattern:

- On the weekly chart, BTC formed a double-top pattern, signaling a potential downward trend.

- The target price based on this pattern is $50,982, a four-month low. The “sell in May and go away” sentiment impacted spot BTC ETF inflows2.

In conclusion, the crypto market in July 2024 is marked by excitement around Ethereum ETFs and the unexpected impact of the “Trump trade.” While risks persist, informed investors should stay vigilant and consider these factors when making decisions. 🚀📈