How Trump’s Tariffs Are Shaping the Crypto Market

Trade War 2025

The Intersection of Politics and Crypto This week, the global markets are buzzing with news of President Trump’s latest tariff policies targeting major trading partners like China, Canada, and Mexico. While these tariffs aim to protect domestic industries, they’ve sparked uncertainty across financial markets—including the crypto space.

What’s Happening? Trump’s tariffs include a 25% levy on imports from Canada and Mexico and a 10% tariff on Chinese goods2. These measures have led to retaliatory actions from affected countries, creating a trade war scenario. The crypto market, known for its sensitivity to macroeconomic trends, has felt the impact.

The Crypto Market’s Reaction Following the announcement, the cryptocurrency market saw an 8% drop in total market capitalization. Bitcoin, often viewed as a hedge against traditional market instability, experienced a price dip, nearing $75,000. Analysts suggest that the tariffs could escalate inflation, reduce consumer spending power, and hinder economic growth—all factors that weigh heavily on high-risk assets like cryptocurrencies2.

Why Does This Matter for Crypto Investors? Trade tensions and tariffs create a domino effect:

- Market Volatility: Increased uncertainty leads to sell-offs in both traditional and crypto markets.

- Inflation Concerns: Higher costs for goods can diminish purchasing power, affecting investment behavior.

- Strengthening of the U.S. Dollar: A stronger dollar often correlates with weaker crypto prices.

However, there’s a silver lining. Some traders are optimistic about Bitcoin’s resilience, with long positions rising to 54%. This suggests that while short-term volatility is inevitable, the crypto market may recover as investors seek alternatives to traditional assets.

What is the total of the tariffs imposed on china?

The total tariffs imposed on China by the United States currently stand at 145%. This includes a 125% tariff rateannounced recently, along with an earlier 20% levy2. These tariffs are part of an escalating trade war between the two nations, with significant implications for global markets and industries, including cryptocurrency4.

Let’s dive into the numbers and explore the broader impact of Trump’s tariffs on global trade and the crypto market. Here’s a data-driven approach:

- Tariff Rates: The U.S. recently imposed a 145% tariff on Chinese imports, up from the previous 125% rate2. This marks one of the most aggressive trade escalations in recent history.

- Economic Impact: The tariffs have disrupted global trade, with an estimated $10 trillion wiped out from global equity markets over three days. This accounts for roughly 10% of global GDP, showcasing the scale of economic uncertainty.

- Sector-Specific Effects: Industries like luxury goods, automotive, and technology are facing significant challenges. For example, Hermès announced price hikes due to a 10% tariff on European imports, affecting consumer demand.

- Crypto Market Reaction: Bitcoin saw increased liquidation activity, with peak liquidations totaling $680.91 million between April 3 and April 17. This highlights the sensitivity of cryptocurrencies to macroeconomic events.

- Global Trade Dynamics: Over 57 countries are now subject to increased tariffs, with baseline rates starting at 10%. Developing nations in Asia and Africa are among the hardest hit5.

China has responded to the escalating tariffs with a mix of retaliatory measures and strong rhetoric:

- Reciprocal Tariffs: China has imposed 125% tariffs on U.S. imports in retaliation to the U.S.’s 145% tariffs on Chinese goods2. This tit-for-tat escalation highlights the intensifying trade war.

- Criticism of U.S. Policies: Chinese officials have labeled the U.S. tariffs as “unilateral bullying” and “irrational”, emphasizing that these actions violate international trade rules2.

- Economic Adjustments: To counteract the economic impact, China is expected to maintain its benchmark lending rates while exploring additional stimulus measures to stabilize its economy.

- Rare Earth Export Restrictions: In a strategic move, China has restricted exports of key materials like rare earth metals, which are critical for industries such as semiconductors and aerospace.

- Diplomatic Stance: While expressing a willingness to negotiate, China has warned that it will “fight to the end” if the U.S. continues its aggressive tariff policies1.

This ongoing trade conflict is creating ripple effects across global markets, including the cryptocurrency space.

Let’s peel back the layers of blockchain’s transformative role in global trade, where transparency meets efficiency on a global scale.

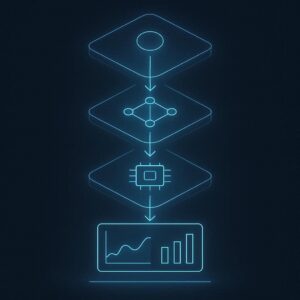

1. Revolutionizing Supply Chains

Blockchain has reshaped the traditional supply chain by providing real-time tracking of goods and materials. It ensures authenticity and provenance, giving businesses confidence in product origins—vital in industries impacted by tariffs and trade disputes. For example, companies can verify whether materials comply with trade policies, avoiding penalties or tariffs.

2. Streamlined Cross-Border Payments

Trade tariffs often complicate payment processes, but blockchain simplifies cross-border payments with cryptocurrenciesand stablecoins. These tools reduce fees, eliminate middlemen, and speed up transactions—key benefits for businesses navigating tariff-induced financial strain.

3. Tokenization of Trade Assets

Tokenization allows companies to convert trade assets, like commodities or invoices, into digital tokens. This offers:

- Fractional Ownership: Lower entry barriers for investors in global markets.

- Liquidity: Faster conversion of assets into liquid funds to tackle market uncertainties.

- Transparency: Secure asset tracking via decentralized ledgers.

4. Smart Contracts for Tariff Management

Smart contracts automate processes tied to trade tariffs and compliance. For example, they can:

- Adjust payments dynamically based on tariff changes.

- Ensure automated checks for adhering to regulatory standards. This prevents costly errors and accelerates transactions.

5. Mitigating Trade Risks

Blockchain creates trust networks by enabling shared access to transaction data among all stakeholders—exporters, importers, regulators, and investors. This transparency minimizes fraud, disputes, and risks, especially during geopolitical tensions like the ongoing U.S.-China trade situation.

6. Strengthening Decentralized Trading Platforms

Blockchain-powered trading platforms bypass traditional market gatekeepers. They connect buyers and sellers directly, creating more resilient markets. For industries affected by tariffs, these platforms enable global trade without reliance on costly intermediaries.

7. A Bridge to Digital Trade Infrastructure

As countries adapt to a digital trade ecosystem, blockchain becomes the backbone. It integrates seamlessly with IoT, AI, and automated systems, driving innovation in logistics, tariff management, and trade analytics.

it’s less of an “if” and more of a “when.” Blockchain’s ability to provide transparency, security, and efficiency makes it the ideal candidate for revolutionizing global trade. As industries and governments increasingly explore its applications, the pieces of the puzzle are steadily falling into place.

What’s really exciting is how blockchain could streamline customs processes, enable real-time tracking, and reduce trade disputes through smart contracts. Plus, with the rise of tokenization, even complex commodities like oil or rare earth metals could be traded seamlessly on blockchain networks.

It’s only a matter of time before we see global trade systems moving away from traditional practices toward a more decentralized, blockchain-enabled infrastructure

Looking Ahead As the tariff policies unfold, the crypto market will remain a key indicator of global economic sentiment. For investors, staying informed and agile is crucial. Whether you’re trading Bitcoin or exploring altcoins, understanding the macroeconomic landscape can help you navigate these turbulent times.

Shoutout to my indispensable AI copilot for keeping my ideas sharp and my vision focused.