The Ripple Effects

How Recent Geopolitical Turmoil is Shaping Global Markets and Cryptocurrencies

The world has been witnessing a series of significant political events that are reshaping the geopolitical landscape and potentially impacting the global market. From the ongoing conflict between Palestine and Israel to the fall of Syria’s Assad regime, the return of Donald Trump as the President of the United States, and the resignation of Canadian Prime Minister Justin Trudeau, these events are creating waves of uncertainty and change.

Palestine-Israel Conflict

The conflict between Palestine and Israel has escalated once again, leading to devastating consequences for both sides. The ongoing war has resulted in significant loss of life and destruction of infrastructure. The international community is calling for a ceasefire, but the situation remains volatile. This conflict has the potential to disrupt global oil supplies and increase geopolitical tensions in the Middle East.

Fall of Syria’s Assad Regime

In a surprising turn of events, the Assad regime in Syria has fallen. The opposition forces, backed by international support, have taken control of the capital, Damascus. This marks the end of an era and raises questions about the future stability of Syria and its neighboring countries. The power vacuum left by Assad’s departure could lead to further instability in the region, affecting global markets and trade routes.

Trump’s Return and Its Impact on Cryptocurrency

Donald Trump has been re-elected as the President of the United States, and his return has already started to impact the cryptocurrency market. Trump’s administration is expected to introduce new regulations and policies that could either boost or hinder the growth of cryptocurrencies. The uncertainty surrounding these changes is causing fluctuations in the crypto market, with investors closely monitoring the developments.

Trudeau’s Resignation and Trump’s Proposal for Canada

Canadian Prime Minister Justin Trudeau has announced his resignation amid growing political pressure. In a bold move, Donald Trump has proposed that Canada join the United States as the 51st state. While this idea has been met with skepticism and resistance from Canadian leaders, it highlights the unpredictable nature of current political dynamics.

Trump’s Strategic Island Purchase

Trump’s administration has also expressed interest in purchasing a strategically important island, Greenland. This move is seen as an attempt to strengthen the United States’ military presence in the Arctic region and secure valuable natural resources. The potential acquisition of Greenland could have far-reaching implications for global geopolitics and trade.

Lebanon’s New Leadership and Border Tensions

Lebanon has finally elected a new president, Joseph Aoun, and appointed Nawaf Salam as the prime minister. This development comes after a prolonged political vacuum and ongoing border tensions with Israel. The new leadership faces the daunting task of stabilizing the country and addressing its economic challenges. The situation in Lebanon could influence regional stability and impact global markets.

Fires Devastate Los Angeles

Meanwhile, in the United States, devastating wildfires have ravaged Los Angeles, causing significant damage and loss of life. The fires have disrupted daily life and strained emergency response resources. The economic impact of these fires is expected to be substantial, affecting local businesses and the broader economy.

These recent political events are creating a complex and uncertain global landscape.

The ripple effects of these developments are likely to be felt across various sectors, from energy and trade to finance and technology. As the world navigates these turbulent times, it is crucial for businesses and investors to stay informed and adapt to the changing geopolitical environment.

Russia, Ukraine, and Germany role

- Russia-Ukraine Conflict: The conflict continues as Russia recently launched its fifth drone attack on Kyiv. Moscow’s offensive tactics remain relentless.

- Germany’s Response: Germany is bolstering its defense measures by deploying long-distance missiles in response to Russia’s aggression, a move backed by the German Foreign Minister, Annalena Baerbock.

- Hybrid Warfare: According to recent reports, Russia has been carrying out hybrid warfare against Europe. This includes cyber attacks, disinformation campaigns, and acts of sabotage. An example of this was the incendiary bomb that ignited at Germany’s Leipzig airport in July 2024.

These ongoing geopolitical tensions are likely to have a profound impact on the global market, especially in terms of energy supplies, cyber security, and overall economic stability.

The United Kingdom has been navigating its own set of political challenges recently.

- Brexit Reset: The UK is attempting to reset its post-Brexit relationship with the European Union, aiming for a more constructive partnership.

- Political Dynamics: The Labour Party, led by Keir Starmer, is working to manage internal and external political pressures, including tensions with Trump and his allies.

- China Relations: The UK is seeking a more consistent strategy in its relationship with China, focusing on cooperation in areas like climate change and trade.

As for Donald Trump, his return to the presidency has brought some interesting proposals:

- State Visit: Trump has expressed interest in making a state visit to the UK, despite previous controversies surrounding his visits.

- Trade Relations: Trump has proposed new trade deals and tariffs that could significantly impact the UK economy.

These developments are likely to influence the UK’s political and economic landscape, adding to the global market’s uncertainty.

Turkey is playing a complex and dynamic role in the recent geopolitical landscape.

Middle East Dynamics

- Syria and Libya: Turkey has been actively involved in both Syria and Libya. In Syria, following the fall of the Assad regime, Turkey is seeking to establish a new Exclusive Economic Zone (EEZ) agreement with Syria’s new government. This mirrors Turkey’s 2019 maritime pact with Libya, which aimed to extend its influence in the Eastern Mediterranean. In Libya, Turkey’s previous intervention secured a critical foothold through military support and negotiations.

Black Sea Strategy

- Ukraine and Black Sea: Turkey’s strategic position in the Black Sea makes it a pivotal player in the ongoing conflict between Russia and Ukraine. Turkey has been collaborating with NATO allies to ensure maritime security in the region while maintaining a delicate balance in its relationship with Russia.

Balancing Act

- Geopolitical Balancing: Turkey is managing a complex geopolitical balancing act, striving to maintain its autonomy while navigating relationships with both Western allies and regional powers. This balancing approach allows Turkey to mediate disputes and assert its influence without fully aligning with any single bloc.

Economic and Strategic Moves

- Economic Initiatives: Amid the changing geopolitical landscape, Turkey is also focusing on economic initiatives and investment opportunities. The recent appointments of experienced policymakers in Turkey’s government signal a closer connection between foreign policy and economic strategies.

Regional Leadership

- Leadership Role: Turkey aspires to assert itself as a regional leader by fostering stronger economic and security relations with its neighbors in the Middle East and Central Asia.

Turkey’s proactive and multifaceted approach in navigating these geopolitical events reflects its ambitions to strengthen its regional influence and economic stability. How these moves will affect the global market and political dynamics remains to be seen.

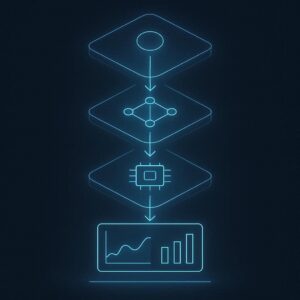

Effect on the global market

The recent political events have created a turbulent landscape that could significantly impact the global market in various ways

- Oil Supply and Prices: The ongoing conflict between Palestine and Israel and the instability in Syria could disrupt oil supplies from the Middle East. This could lead to fluctuations in oil prices, affecting industries worldwide.

- Cryptocurrency Market: With Donald Trump’s re-election and his administration’s expected regulatory changes, the cryptocurrency market may experience increased volatility as investors react to potential new policies.

- Investor Sentiment: Political instability, such as the resignation of Justin Trudeau and the uncertainty surrounding Lebanon’s new leadership, can create fluctuations in investor confidence, resulting in market volatility.

- Global Trade: Trump’s proposal to integrate Canada as the 51st state and his interest in purchasing Greenland could have significant implications for international trade dynamics. These moves could potentially alter trade agreements and create new economic alliances.

- Economic Resilience: The devastating wildfires in Los Angeles are likely to strain local economies and impact the overall economic resilience of the affected regions. The reconstruction efforts will require substantial financial resources, which could have ripple effects on the broader economy.

- Geopolitical Tensions: The combination of these events is likely to increase geopolitical tensions, leading to a more fragmented global market. Countries may reevaluate their trading partners and prioritize national security concerns over economic integration.

These events collectively create an environment of uncertainty and volatility, which can impact global markets through disruptions in trade, changes in investor sentiment, and shifts in economic policies. Businesses and investors should stay informed and adaptable to navigate these challenges effectively.

Ripple Effects on the Cryptocurrency Market

The cryptocurrency market, known for its volatility and rapid changes, is poised to experience significant impacts from recent geopolitical events. As the world witnesses a series of dramatic political developments, here’s a closer look at how these events could shape the future of cryptocurrencies.

Increased Volatility

Geopolitical uncertainty often leads to increased volatility in financial markets.

With the recent escalation of conflicts and shifts in political power, the cryptocurrency market, already characterized by high volatility, could see even more dramatic price swings. Investors may react swiftly to news about conflicts and political instability, leading to significant fluctuations in cryptocurrency values.

Safe-Haven Appeal

During times of geopolitical turmoil, certain assets tend to attract investors seeking stability. Bitcoin, in particular, has shown resilience and has been perceived as a safe-haven asset. For example, during the recent conflict in the Middle East, Bitcoin demonstrated strong performance, acting as a refuge for investors looking to protect their assets from market instability.

Regulatory Changes

The re-election of Donald Trump as President of the United States brings the potential for new regulatory policies affecting the cryptocurrency market. Trump’s administration might introduce changes that could either foster a more favorable environment for crypto adoption or impose stricter regulations that could hinder market growth. The uncertainty surrounding these possible changes is likely to cause fluctuations in the crypto market as investors remain cautious.

Market Sentiment

Investors’ sentiments towards cryptocurrencies can be heavily influenced by geopolitical developments. Political instability, such as the resignation of Canadian Prime Minister Justin Trudeau and the uncertainties in Lebanon, may cause investors to seek refuge in more stable or less-regulated assets, including cryptocurrencies. Market sentiment can drive significant price movements, making it essential for investors to stay informed about global events.

Economic Diversification

Geopolitical risks often drive investors to diversify their portfolios to hedge against potential losses. Cryptocurrencies, being relatively independent of traditional financial markets, may see increased interest as part of diversification strategies. Investors looking to spread their risk and explore alternative assets may turn to cryptocurrencies, potentially driving demand and influencing market trends.

The recent geopolitical events are creating an environment of uncertainty and change, which can significantly impact the cryptocurrency market. As investors navigate these turbulent times, it’s crucial to remain vigilant and adaptable. The interplay between geopolitical developments and the cryptocurrency market highlights the importance of staying informed and making well-considered investment decisions.