Brics Intra-bank payment system (SPFS)

Russia and Iran, as two BRICS members, have finalized the integration of their national payment systems, a significant step toward enhancing their economic cooperation and circumventing U.S. sanctions. The heads of the central banks from both nations have been working closely to link Iran’s SEPAM system with Russia’s System for Transfer of Financial Messages (SPFS)

Strategic Move

Background

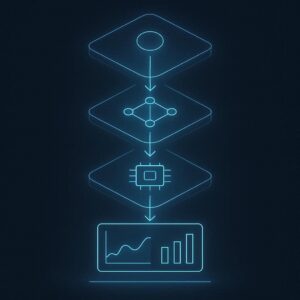

The BRICS grouping, comprising Brazil, Russia, India, China, and South Africa, has been actively seeking ways to reduce reliance on the U.S. dollar in settlement transactions—a process known as de-dollarization. As part of this effort, Russia and Iran have collaborated to create an independent payment system based on blockchain and digital technologies1.

Key Points

- Integration of National Payment Systems:

- Russia’s System for Transfer of Financial Messages (SPFS) and Iran’s SEPAM system have been successfully linked. This integration allows banks in both countries to issue and accept each other’s bank cards, streamlining transactions for businesses and individuals2.

- By bypassing the U.S. dollar, Russia and Iran aim to mitigate the impact of international sanctions and strengthen their economic ties.

- Strategic Implications:

- Enhanced Economic Cooperation: The integrated payment system facilitates smoother trade and financial transactions between the two nations, promoting economic collaboration.

- Geopolitical Considerations: Given the geopolitical context, this move signifies a strategic effort by Russia and Iran to assert their financial sovereignty and reduce vulnerability to external pressures.

- BRICS’ Role: The initiative aligns with BRICS’ broader goal of increasing its influence in the international monetary system. BRICS seeks to create a payment system that is convenient, cost-effective, and free from political interference1.

- Future Prospects:

- The BRICS Bridge multisided payment platform is another project in progress, aiming to improve the global monetary system. Additionally, the Contingent Reserve Arrangement will incorporate currencies other than the U.S. dollar1.

- As blockchain technology and digital currencies evolve, BRICS may continue to explore innovative solutions for cross-border payments and financial stability.

In summary, the BRICS Intra-Bank Payment System represents a strategic step toward financial autonomy and strengthened economic ties between Russia and Iran. It underscores the group’s commitment to diversifying payment mechanisms and reducing reliance on traditional global currencies. As developments unfold, we can expect further advancements in this space3.